Alight: A Highly Durable Business With Long-Term Potential

A high-quality de SPAC inflecting upwards in terms of growth and profitability; expect multiples to re-rate higher (in line with peers) if management can execute their transformation

I wrote this up as part of an interview process for a gig. Didn’t get the job, but learned a lot during the process. Sharing the write-up here. If you have any feedback (good or bad), let me know as I am always trying to improve. Also: a big thank you to @Uncommon_Stocks on Twitter for helping me get up to speed on this name. Shoot him/her a follow!

Alight (NYSE: ALIT, $4.5b market cap) is a well-established company providing health, wealth, payroll administration, and human capital management cloud advisory services to most of the leading companies in the United States. The company exhibits many qualities that make it an attractive long-term investment: this is an extremely sticky business with 97% revenue retention, high levels of recurring revenues, a market-leading position, and a blue-chip customer base. Management also has many levers to accelerate growth further and improve profitability.

Once considered a non-core, capital-intensive business unit of Aon, Alight was spun off and purchased by Blackstone in 2017. Under Blackstone’s ownership, the company focused on shifting away from a labor-intensive business to one better enabled by technology: it moved to the cloud, developed a consumer front-end portal now called Worklife and introduced more automated, scalable ‘business process as a service’ solutions for clients (BPaaS). Blackstone planned an IPO in 2019 but went public via a SPAC deal announced in January 2021, followed by a secondary offering in late 2022.

Investment Thesis

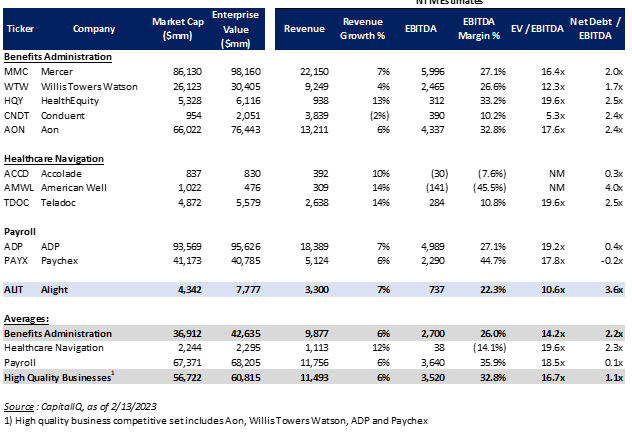

Alight’s SPAC history, continued Blackstone ownership, and high leverage have weighed on Alight’s current valuation. As a result, the market is offering long-term-minded investors an opportunity to purchase a very stable business at <11x consensus forward EV/EBITDA when benefits administration firms with comparable growth and business durability trade between 12-18x (Aon, Mercer, WTW).

Management believes they can accelerate growth at higher incremental margins by shifting away from selling mainly transactional services like benefits and payroll administration to offering more automated, comprehensive solutions leveraging technology and their wealth of data (referred to as BPaaS). If they are successful in this pivot (and able to reduce leverage along the way), Alight’s current valuation gap to ‘high-quality’ peers/competitors such as Aon, WTW, ADP, and Paychex will close.

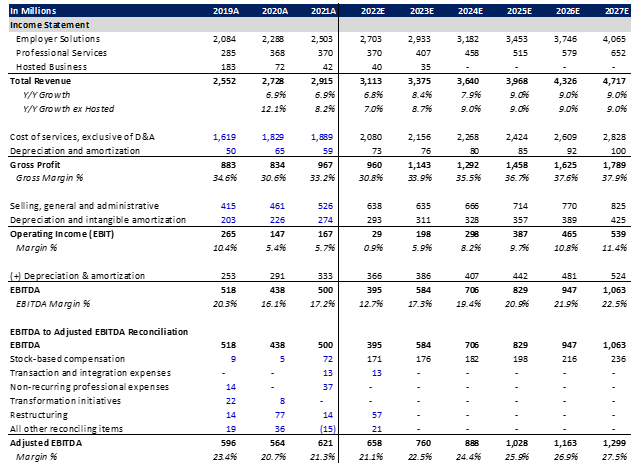

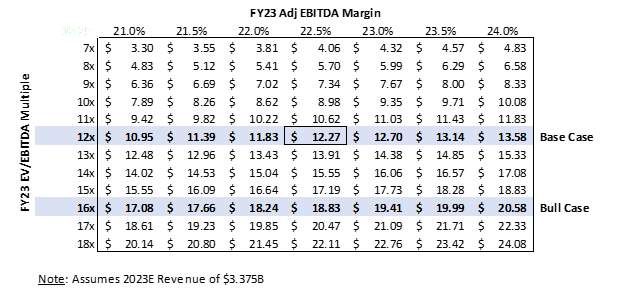

Currently, my FY23 Adj EBITDA forecast of $760mm (at 22.5% margin) at a 12x EV/EBITDA multiple results in a ~$12/share target price (or ~25% upside to the current valuation). Investors searching for durable businesses inflecting upwards in terms of growth and profitability should buy this stock under $8/share (~50% upside, providing a margin of safety to protect from any execution hiccups given success is heavily dependent on the successful implementation of management’s strategy).

In the long run, management has a pathway to ~30% Adj EBITDA margins and high-single-digit top-line growth. This profile, coupled with best-in-class retention and revenue revenues, is desirable for long-term investment, given the potential for the company to accelerate earnings growth and garner multiple expansion.

Business Quality

Alight is a highly durable business, given the non-discretionary nature of its offerings, long-term enterprise contracts, and high level of recurring revenues. Highlights include:

Entrenched long-term relationships with a blue-chip customer base (~70% of the Fortune 500 are clients) provide for high recurring revenues (83% as of 3Q22) via multi-year contracts and thus, a high degree of future revenue visibility.

Well-established domain expertise and operational scale as evidenced by their #1 position in health & welfare administration services and status as the top independent 401k record keeper with $480mm defined contribution assets under administration.

A very ‘sticky’ business with high switching costs for customers. Displacing the incumbent Alight will be difficult for its Fortune 500 clients, given the custom, tailored solutions the company currently provides. Alight’s 97% average client revenue retention, 80%+ customer satisfaction rates, and 15+ year average tenure among its top 25 clients demonstrate just how well-established Alight is among the largest companies in the United States.

Unique capabilities across health, wealth, payroll, and human capital management advisory that competitors cannot offer. This breadth of solutions puts the company in a prime position to consolidate a fragmented market, which benefits both employers and employees. Benefits vendors are often specialized, so companies need to have many different relationships to meet the needs of employees, but Alight Worklife offers a personalized and holistic ‘one-stop shop’.

While Alight has many favorable characteristics, its core benefits administration business operates in a mature industry with long sales cycles – making organic growth more difficult, especially within the Fortune 500. As a result, the company has depended on M&A to expand logos and capabilities. Examples of accretive acquisitions include acquiring Compass in 2018 to expand in healthcare navigation and Hodges-Mace in 2019 to expand penetration in the mid-market. While relying on bolt-on acquisitions is not ideal for driving growth, Alight’s prolific history as an acquirer (9 deals since 2018) should give investors confidence in its deal-making and integration abilities.

From a technology standpoint, Alight touts its proprietary software and AI in investor materials. However, its capabilities in these areas are still relatively new (‘Data & AI capabilities’ were introduced in 2020), so its technological moat is still developing. As Alight continues to become a business with more technology-enabled automation and scale, its expertise in this arena should improve – especially if it can effectively leverage its ~25 years of client data.

Future Prospects

Alight’s transformation toward “standardized, scalable, next-generation platforms” should allow the company to both accelerate growth and lower their incremental costs to serve clients. Alight can:

Expand sales with existing customers via cross-selling and simplifying the customer experience through BPaaS and Worklife. A 10% increase in cross-selling is +$130mm in revenue.

Expand with mid-market companies (1-10k employees) where Alight’s new technology should allow it to scale better than in the past. Currently, the company boasts ~2,500 mid-market customers or just ~6% share of a ~$60B TAM.

Increase international sales (only 15% of FY22 revenue), particularly within HCM advisory services.

Make bolt-on acquisitions to add new clients, capabilities, markets, and cross-selling opportunities.

From a profitability standpoint, Alight’s continued technology transformation allows the company to grow at higher incremental EBITDA margins and realize more operating leverage compared to its history:

BPaaS solutions have over ~500bps higher margins compared to standalone benefit administration deals. BPaaS sales are growing ~10x faster than the company overall and comprise ~20% of revenues (3Q FY22).

Continued expansion of its Worklife platform to improve customer experience and reduce costs. For example, Worklife is contributing via a lower volume of customer calls. With Alight fielding ~4mm calls at a ~$10/call cost, a significant upside exists for Worklife to increase EBITDA margins.

BPaaS and Worklife will allow Alight to better compete in the mid-market by reducing costly implementation costs historically associated with onboarding new clients. In the past, Alight provided very customized solutions, but now has the scale to offer the same solutions via a more standardized, automated platform.

Alight has untapped pricing power. While current contracts have mechanisms to adjust for inflation (based on the Employment Cost Index), Alight has great potential to capture more margin via ‘outcomes-based pricing’ where they receive a cut of the cost savings they deliver to clients.

Management

On the surface, the management team appears capable of executing transformations within technology and not overly promotional (having outperformed its original SPAC projections thus far). CEO Stephan Scholl joined Alight in 2020 after 25 years in the technology sector with Oracle, PeopleSoft, and Infor. At Infor, Scholl led a legacy, on-premises enterprise ERP software company and moved their offerings to the cloud. In a couple of years, he says he took the company from 2% revenue from cloud-based solutions to 55%. Scholl considers Alight a “25-year-old startup” and seems confident executing the same strategy as he did at Infor. Alongside Scholl is CFO Katie Rooney, who was previously CFO for Aon Hewitt and has held senior positions at Aon since 2009. SPAC sponsor Bill Foley has a track record of creating value at similar companies like Ceridian and Dun & Bradstreet.

Current Valuation

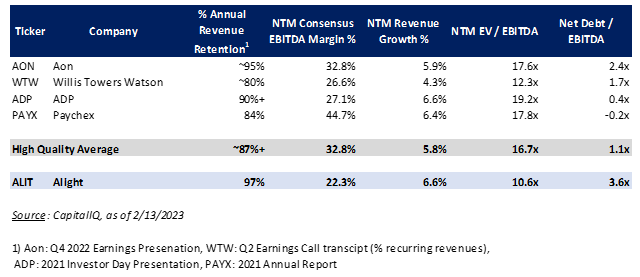

Alight is currently trading at a discount to peers that I consider to be high-quality businesses: Aon, Willis Towers Watson, ADP, and Paychex. These competitors all have top-tier average revenue retention, generate sales mainly from recurring business, and average ~30%+ EBITDA margins while growing revenues MSD. Given these attractive characteristics, this basket of names trades at ~17x forward EV/EBITDA.

These companies comprise an aspirational peer set for Alight. Suppose management can continue to execute their transformation and march closer toward a ~30% EBITDA margin in a couple of years while reducing leverage. In that case, Alight deserves to trade closer to the ~17x multiple this peer set currently commands. The durability of Alight’s business is among this elite group, but its $2.8 billion in net debt on the balance sheet, SPAC roots, and ~10% Blackstone ownership weigh on its multiple today.

Alight vs Companies with comparable business durability

My base case assumes a valuation of $12/share, or ~25 % upside based on a 12x multiple off a $760 FY23 Adjusted EBITDA estimate (22.5% margin with revenues nearly growing 9% vs. FY22, excluding the hosted business).

A block sale in Q4 2022 priced at $7.75 provided a great entry point for long-term investors. Since then, shares have rallied ~25%. Given that future growth is reliant on M&A and management execution than its peers, I believe that an $8/share entry point provides an appropriate margin of safety for a company that still needs to demonstrate that growth and profitability are inflecting upward.

Appendix