Civitanavi Systems SpA: A High Potential Aerospace & Defense Supplier

Fast-growing, profitable founder-led Italian microcap that appears to be the leader in their niche, have manufacturing cost advantages, and partnerships with Tier 1 OEMs

Civitanavi Systems S.p.A. (Euronext Milan: CNS; €115 market cap) is a fast-growing, profitable founder-led Italian microcap company that appears to be the leader in their niche and has a manufacturing cost advantage, as validated by long-term partnerships with Tier 1 OEM’s such as Honeywell. The stock trades at ~8x FY23 Adj EBITDA, representing a compelling opportunity to buy into a high-potential growth company at a reasonable price.

Civitanavi designs, develops, produces, and markets high-end inertial navigation sensors for Aerospace & Defense and Industrial uses. Inertial navigation sensors and systems (INS) make it possible to accurately calculate the speed, direction, and positioning of mobile objects without GPS. INS are very important as they represent the only way to autonomously detect the position of any device and the direction of its motion when the GPS signal is not available or obstructed.

Civitanavi is an emerging market leader in FOG (fiberoptic gyroscope) based inertial navigation products that are ITAR-free (or not subject to ‘International Traffic in Arms Regulations’ set by the United States government). FOG is a newer technology for inertial navigation that is taking market share from legacy technologies such as RLG (ring laser gyroscopes) that have been around since the 1960s. FOG-based offerings provide high-performance relevant for many applications at a competitive cost. On the other hand, RLG is a legacy technology that offers strong performance and reliability but is costly. In addition to FOG, Civitanavi also leverages newer MEMS technology (micro-electro-mechanical systems), which offers compact size and low cost but is not as accurate as FOG or RLG.

Admittedly, it is quite hard for a layman like me to gauge this company’s competitive differentiation, but it appears that we have a vertically integrated manufacturer with:

Unique expertise in manufacturing high-performance, ITAR-free FOG-based inertial navigation products that other European competitors have not been able to achieve

Cost advantages based on some sort of specialized expertise and proprietary knowledge/manufacturing process with fiber optics

Founder-led management team with impressive technical chops and credentials

Executive Summary / Key Thesis Points

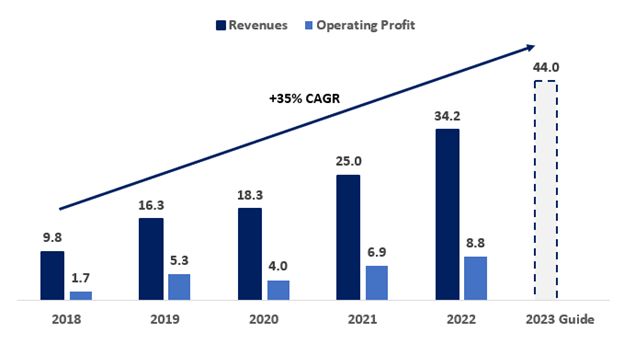

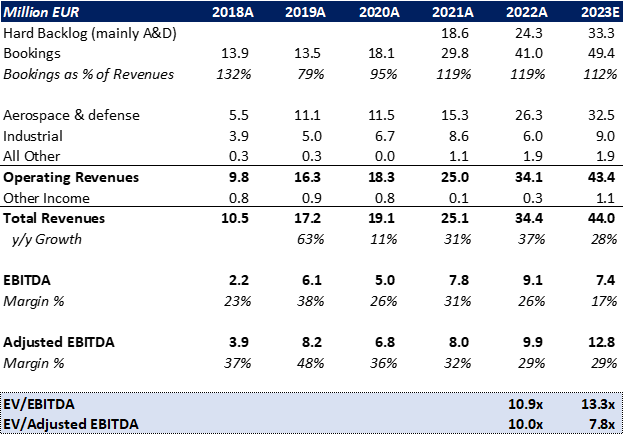

Founded in 2012, Civitanavi is early in its growth stage but has been able to achieve impressive revenue growth (60% CAGR from 2012 to 2021) while delivering EBITDA margins of 25-35% and positive free cash flow starting in 2019.

Despite being a young microcap company, it appears that Civitanavi has carved out a unique niche in the global INS marketplace. They were the first to develop ITAR-free INS based on FOG technology for high-performance applications. They remain the only manufacturer offering this technology to the aerospace sector in Europe.

The company has a cost advantage relative to the competition. Civitanavi’s unique expertise in adding proprietary design and manufacturing to cheaper, off-the-shelf fiber optic components normally used in the automotive or telecom industries is a source of cost advantage.

Civitanavi’s technology is validated by a top-notch roster of customers, such as Honeywell, Leonardo, and BAE Systems. Aerospace & defense commercial partnerships are quite sticky for Civitanavi as they require long-term cooperation and integration with the OEMs.

The company primarily used IPO proceeds to expand production capacity. In 2022, they delivered FCF margin of ~20% and paid a dividend (yield: 3.5%); a share buyback program is currently active.

This opportunity exists because it is a new IPO trading in Milan and most of the shares are held by insiders. Since the IPO, shares are -5% but most recently declined ~20% after the company reduced revenue guidance in December 2022.

Historically, Civitanavi has achieved impressive returns on invested capital (25%+ since 2018) and return on equity (33%+).

With the market resetting expectations to more achievable near-term revenue guidance (still nearly 40% y/y growth in 2023), the stock’s current valuation (~8x EV / FY23 Adj EBITDA) is not particularly demanding for a well-positioned, competitively advantaged company expected to achieve ~30% revenue growth for the foreseeable future at ~25%+ EBITDA margins, which they consistently achieved before going public.

Brief Company History

The company was founded in 2012 by Andrea Pizzarulli and Mike Perlmutter, both of whom are very accomplished industry experts. Pizzarulli serves as Civitanavi’s CEO. He was previously Founder & CEO of Xanto Technology, a start-up developing cryptographic embedded systems. Before that, he worked as an engineer for advanced optronic subsystems for the telecom industry. Perlmutter worked at Raytheon and Northrup Grumman. In addition, he was a founding partner of Fibersense, a US aerospace company that was acquired by Northrup. Perlmutter has authored or co-authored 17 patents on inertial sensors, GPS, and navigation technology.

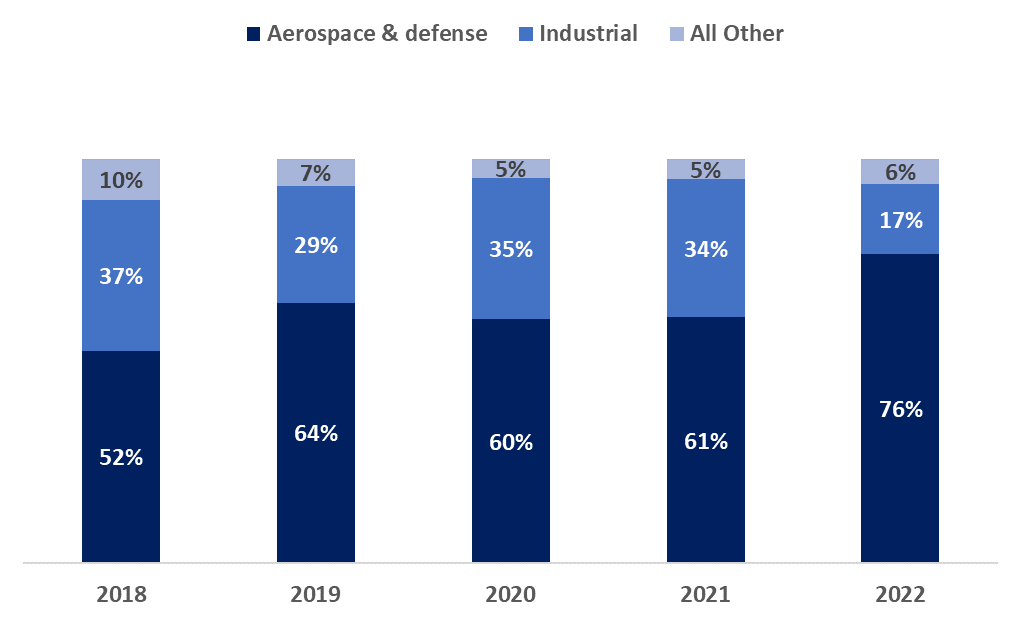

In its early years, Civitanavi sold inertial navigation systems for industrial uses with a focus on oil & gas and mining. In 2015, the company expanded into the aerospace & defense sector after securing Italy’s Piaggio Aerospace as a customer. They went on to secure contracts with Tier 1 OEM manufacturers, such as Leonardo (2017) and BAE Systems (2019). In recent years, Civitanavi has expanded the end markets for its products to eVTOLs and space launchers. The company listed on Euronext Milan in February 2022 to raise €31 million to expand production capacity and support product innovation.

In their IPO prospectus, Civitanavi guided to annual sales growth of +46% y/y in 2022 (using management’s midpoint guidance) and +61% in 2023. In December 2022, the company revised the outlook lower to 2023 growth of +38% y/y (midpoint) due to energy costs, ongoing supply shortages, and orders shifting out into the following years.

Historical Operating Revenues (ex. Other Income) and Operating Profit

% of Revenues by Segment

Market Dynamics

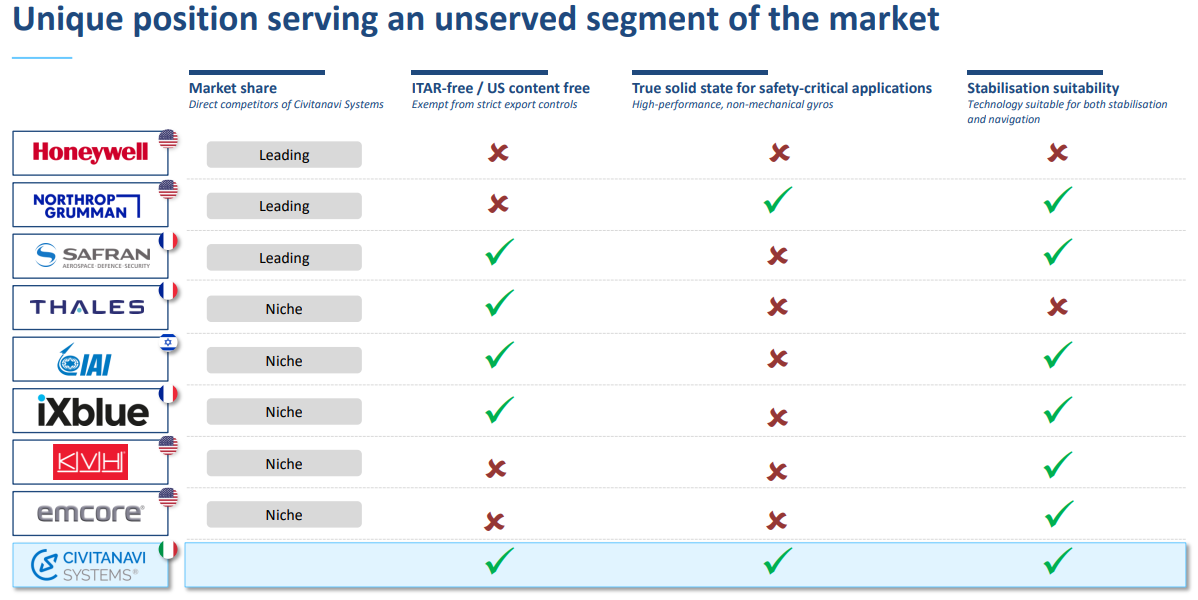

The global market for high-end inertial sensors was approximately USD 3.2 billion in 2019 and is expected to grow at a +6% CAGR from 2020 to 2025, according to industry consultancy Yole. The Europe & Middle East markets account for $0.7B of the total. Within the industry, the ITAR-free segment is expected to grow faster than the overall market. The space is dominated by a few large aerospace & defense companies: Honeywell (~40% market share of the global INS market), Northrop Grumman (~20%), and Safran (~20%). Honeywell’s offerings are primarily based on RLG, while Northrop and Safran’s businesses are balanced between RLG, FOG, and MEMS systems.

As the company explains in the latest annual report: “High-end inertial sensors cover many markets. They are used as simple single-axis and low-cost configurations in industrial applications or highly integrated multi-axis applications as inertial measurement units (IMUs), attitude and heading reference systems (AHRS), and high-performance, high-cost inertial navigation systems (INS) in mobility applications (civil aviation), defense, and aerospace.”

Looking to the future, key catalysts for inertial sensor industry growth include 1) modernization of defense assets, 2) increase in EU defense spending to NATO’s 2% of GDP guideline, 3) organic increase in demand for military equipment not solely reliant on GPS and 4) new end applications such as space, robotics, logistics.

Competitive Advantages

Despite its small size, CNS has the unique position as a supplier of inertial systems that are:

ITAR-free

Have a true-solid state (high performance, non-mechanical gyros for safety-critical applications)

Provide both stabilization and navigation functions.

Civitanavi boasts that they are the only company that offers all three features in the marketplace, as you can see from the screenshot from their IPO prospectus below.

Civitanavi’s claims appear to be validated externally. In 2016, Civitanavi received an R&D grant from the European Union to develop their non-ITAR FOG-based inertial navigation equipment for aeronautical applications after a competitive evaluation process (Link). In the same year, Civitanavi presented a technical paper explaining that the firm had “developed what [they] believe is the first ITAR-free INS based on FOG technology certified (DO-178, DO-160, DO-254) for high-performance airborne applications” with laboratory test data at an industry conference.

In 2019, the company was selected to be the sole supplier of INS as part of BAE System’s Tempest program. Tempest is a UK-led defense program to develop next-generation combat aircraft for the UK’s Royal Air Force and allies. BAE selected Civitanavi to provide the inertial equipment for the ‘demonstration’ phase of the program, further validation that this small upstart’s technical capabilities are indeed a competitive edge. The Tempest fleet may enter service in 2035.

More recently, Civitanavi entered a commercial partnership with Honeywell in July 2022 to develop new inertial measurement units for aerospace customers. Honeywell explained that this new product will utilize “next-generation MEMS Accelerometer technology, coupled with Civitanavi Systems’ low-cost, high-performance FOG sensors to provide a new suite of products”.

Business Model

Within aerospace & defense customers, Civitanavi generates revenues in two primary ways: 1) earning one-off fees and royalty payments from customers as part of joint product development, which typically last several years, 2) fixed lump-sum payments through participation in long term development programs where business is typically awarded after a competitive bidding process. The industrial sector business is straight forward and while not a recurring revenue model, provide a more consistent level of revenues.

Capital Allocation

Civitanavi achieved free cash flow margins of ~20% in 2022, and the Board approved a dividend of 0.13€ per share (3.5% dividend yield) in that year. In addition to the dividend, there is a share repurchase program in place (to buy up to ~4% of shares). The firm is actively purchasing shares, albeit in very small amounts since the program was approved in the spring of 2023. The firm used proceeds from the IPO to accelerate growth via investing in capex to expand production capacity and establish new locations.

How many microcaps are growing ~40%, investing in the business to fund future growth and have both a dividend and share buyback program in place?

Recent Results & Valuation

Civitanavi reported 1H 2023 results in September. Revenue increased +60% y/y but Operating Profit was negative due to one-time expenses, primarily a 4.5mm € stock option expense (non-cash and paid by the majority owner holding company). Adjusted EBITDA margin came in at 20% (+12% y/y growth in EBITDA $).

For the full year 2023, management stuck to their guidance of 42-46€ revenue and Adjusted EBITDA margin of 29%. If they can deliver these results, then the stock is currently trading at ~8x Adjusted 2023 EBTIDA.

Key Risks

Customer concentration: Per the IPO prospectus, the top five customers made up roughly 2/3 of sales which puts the company in a tough position if contracts with these main clients are not renewed.

Change in ITAR government regulations: If ITAR regulations were to change around inertial navigation systems, Civitanavi would be adversely affected. ITAR-free products are sought out by European (and other) customers and do command a slight price premium.

Key Man Risk if CEO or co-founder exit the business

Conclusion

Qualitatively, there are many favorable characteristics that the company shares with multi-bagger microcaps: 1) founder-led firm with significant insider ownership, 2) competitive advantages within their niche, 3) long-runway of growth with impressive returns on invested capital (25%+ since 2018) and return on equity (33%+) and 4) sensible capital allocation.

Civitanavi has averaged ~25-30% EBITDA margins before going public. If they can sustain 30%+ revenue growth over the medium to long term at those historical margins, then the stock is headed much higher with or without a multiple rerating.

Great write-up. How did you find this company?