Table Trac: A Nano Cap Software Company At An Inflection Point

Founder-led casino software maker with recurring revenue, low churn and long growth runway

Company Description

Table Trac (OTCQX: TBTC) is a growing nano-cap company that sells casino management system (CMS) software and services to over 200 casinos worldwide. The company's products are valued by its casino operators (industry-leading annual retention) and generate high margin, monthly recurring revenues after installation. TBTC's 'CasinoTrac' CMS suite includes real-time automated table and slot machine monitoring, as well as functionality for casinos to manage loyalty, marketing programs, perform required audit/accounting tasks and business analytics. The system is marketed as affordable, easy to use and able to interface with third-party software. Target customers include tribal and commercial small to medium-sized casinos.

Led by its founder and largest shareholder, the company has a long runway of growth ahead given the multi-billion dollar total addressable market for CMS software. It also will benefit from significant operating leverage and a corresponding step change in EBITDA growth, which the market has not yet factored into the company's valuation. Based on my estimates, the stock trades at less than 6x EV / 2021 EBITDA. This is a bargain for a high-quality, sticky SaaS-like business with 75% gross margins that is coming out of the pandemic with record customer demand.

Market Opportunity + Competition

There are nearly 1,000 total casinos in the United States, including 525 tribal casinos and thousands of non-casino locations with slot machines (ie. bingo halls, bars/restaurants). According to the American Gaming Association, there are over 16,000 total locations with electronic gaming machines nationwide.

Every casino needs a management system to ensure audit, reporting and compliance to their gaming commissions, in addition to monitoring and optimizing gaming operations. As a result, casino management software is a multi-billion dollar industry. The CMS market is dominated by four large players who also manufacture casino games: Aristocrat (ALL.AX), Bally Systems (part of Scientific Games - SGMS), IGT (IGT) and Konami (KNMCY). While the big players control the majority of the market share, the CMS business is an ancillary revenue stream for these companies. For example, Aristocrat IR informed me that CMS revenues contribute less than 5% of their total sales.

Table Trac currently has over 200 systems installed worldwide so they have barely scratched the surface in terms of market penetration, despite growing revenues at a 20% compound rate from 2015 to 2019. In the US, gaming is highly regulated and manufacturers need to receive approvals from local/state gaming commissions before selling to commercial casinos (tribal casinos have different rules). TBTC is one of the only CMS providers outside of the big players to have state approvals to sell their product in multiple states including Nevada, Colorado, Minnesota, Maryland, Iowa and South Dakota. Outside of the US, they sell to locations in the Caribbean, Central and South America, Australia and have a strategic partner in Japan once the first casinos are built there.

Table Trac's Customer Value Proposition

While the big competitors are focused on selling gaming machines, Table Trac's sole priority is listening to the needs of casino operators in order to deliver the most robust CMS software. Table Trac is small and nimble, allowing it to quickly incorporate customer feedback and deploy software enhancements. It effectively competes on price, customer service, innovation and security.

Price: The CasinoTrac suite is 30-50% cheaper than the big player alternatives, but offers similar (or better) functionality. In addition, TBTC does not charge for software upgrades. As COO Bob Siqveland told me, casino operators can get expensive surprise upgrade fees and software integration costs from competitors that lead them to explore CasinoTrac. He cited an example of when a casino was told the CMS upgrade would cost $700K and their older software would no longer be supported.

Customer service: TBTC offers 24/7 support from US-based technicians. Casinos know who they are talking to and often request specific techs. On the other hand, competitors often outsource services to foreign call centers and rely on third parties, such as Microsoft and Oracle (and pay them). The CasinoTrac CMS is completely self-contained.

Innovation: Despite having just five dedicated R&D employees (including the CEO), Table Trac is on the cutting edge of CMS technology. The company holds three patents: one for an automated table game monitoring system, another for technology that allows patrons to control a gaming machine with their cell phones and lastly, one for automated enforcement of social distancing at gaming machines. Two of these patents were granted after 2020. Since the pandemic, the company was able to roll out new CasinoTrac features for their clients very quickly, allowing those casinos to re-open faster.

Cybersecurity: Casinos are popular targets for ransomware attacks: they have a lot of cash and personal information on customers. Just last month, a group of six tribal casinos in Oklahoma had to shut down all operations after an attack, something that has become more and more common in the past few years.

CasinoTrac protects customers from cyberattacks in ways that comparable CMS software cannot. First of all, CasinoTrac is Linux-based while other CMS software run on Windows. This is relevant because hackers have historically targeted Windows the most since it is the most common operating system. In addition, CasinoTrac offers unmatched stability. The software runs on one server and if there is a catastrophic error, CasinoTrac folds over to a secondary server that has been backing up data in real-time, resulting in less than a minute of downtime. On the other hand, competitor CMS software has double-digit number of servers due to clunky technology that is a result of many years of acquiring product and slapping it to existing code. System outages on competitor software can last hours, which is extremely costly for casino operators.

CEO Chad Hoehne explained to me that "the CasinoTrac architecture is extremely stable, fast, thin and doesn't require as many resources with the way we store the data. It has incredible capacity and will also self-recover from a catastrophic power outage". He also noted that several CasinoTrac clients have been hit by hackers on their Windows-based workstations in recent history as well. In these cases, however, the gaming floor, ticket machines, accounting were not affected at all because they were running on CasinoTrac.

Catalysts

It may be counter-intuitive, but Table Trac is coming out of the pandemic as a stronger company even though their customers were disproportionately impacted by COVID-19. A big reason is that the pandemic forced casino operators to pay more attention to their operating budgets. Table Trac received a record number of unsolicited calls from casinos looking to reduce their CMS expenses.

All of the sudden, price had become the #1 differentiator when it came to picking a CMS provider. Siqveland explained:

The industry has changed. It is much more budget minded now and this has given us the opportunity.

The company now has a record-high backlog of system sales waiting to be delivered. There are 9 systems currently in the backlog (2-3x greater than historical amounts). I conservatively estimate this to be worth ~$2.5 million in revenue (based on historical sales), or 2/3 of the total system sales revenue in 2019.

Some of these systems in the backlog are for California commercial customers. TBTC is currently waiting to be approved by the California Gambling Control Commission as a licensed manufacturer. This would allow it to sell its systems to the commercial card rooms in the state (they already sell to tribal casinos in the state, which are governed separately). It is just a matter of when, not if, the company will receive its California license. TBTC received its Nevada license in 2016 and that opened up an important sales opportunity for the CasinoTrac software in that state with over 300 casino locations. California approval presents a similar opportunity, opening up a potential market of ~90 commercial card rooms.

Not only is customer demand booming, but Table Trac continues to develop new products. The company hired a person to develop a new data analytics / business intelligence offering called "DataTrac" that is being sold to existing CasinoTrac customers as a premium add-on as well as to brand new casinos/ The product has been rolled out to 10 locations already and represents a multi-million dollar recurring revenue opportunity.

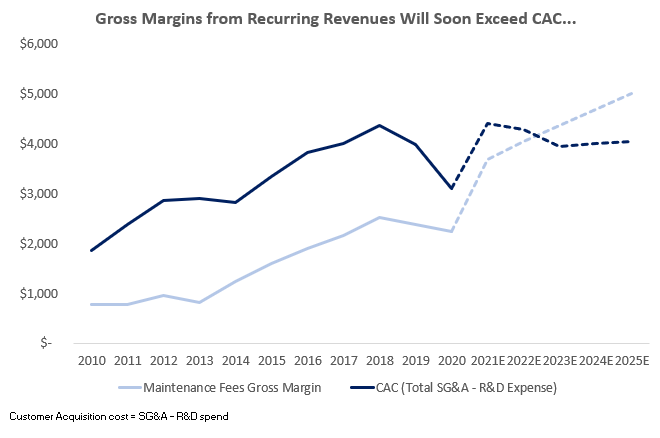

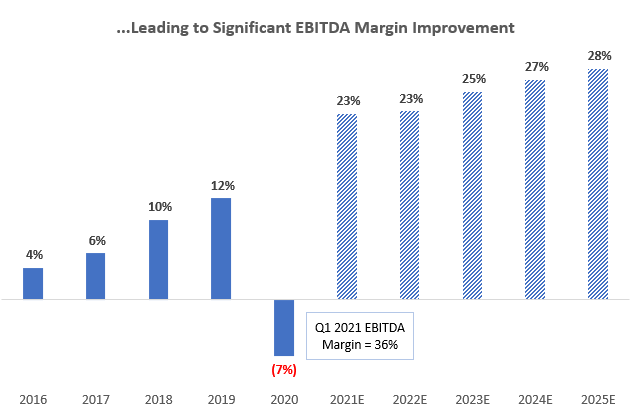

Lastly and most importantly, TBTC is on the cusp of benefiting from significant operating leverage. Table Trac's underlying unit economics are enviable. The lifetime value of new customers has historically been 2-3x times the customer acquisition cost due to the recurring maintenance revenues that come with each new system delivery (not to mention that churn is very low). The issue is that SG&A expenses relative to revenues have been very high. This is because the SG&A expenses are weighted heavily toward fixed costs, with the largest bucket being employee salaries (ex: executive compensation alone comprised one-fifth of total SG&A in 2020). However, this dynamic will change in the next 1-2 years since Table Trac is very close to having their recurring maintenance revenues (and gross profits) entirely cover their SG&A expenses. Once they achieve this level, gross profit from CMS system sales (~65% margin) will flow right to the bottom line. The massive impact of this leverage on EBITDA margins is illustrated below:

Even if Table Trac does not sell one more new gaming system, the company will be able to rely on its stable stream of maintenance revenues. Under this scenario, the company will likely even be close to breaking even. As a result, Table Trac's downside risk is capped in my opinion.

Japanese Gaming Market Potential Is A Call Option

One 'call option' that I did not mention as a catalyst is the potential for Table Trac to become Japan's de facto standard CMS provider once the first casinos are built in the country. In 2018, Japan legalized casino gambling, but no casinos have been approved at this moment. Given its large population and popularity of pachinko (a Japanese niche arcade game comparable to slot machines), Japan is considered one of the gaming industry's most promising new markets.

In 2019, TableTrac signed an agreement with Japanese security firm, Broadband Security (4398.T) to "rebrand, adapt and market their casino management system (CMS) to the developing Japanese gaming market". Broadband Security explained their plans for leveraging Table Trac's CMS software in a late 2019 investor presentation:

"We will improve the function of the system to meet the legal requirements of Japan and make additional developments such as biometric authentication function and ensuring general data security so that data can be linked with related organizations. The newly refurbished CMS will secure the status of "Japan's de facto standard CMS" and aim to ensure that the business in Japan is operated in the safest and most robust manner in the world."

Table Trac recognized $1.2 million of revenue related to this deal in 2019, but has not had any Japan related revenues since then. I do not have any Japan revenues built into my projections for the company.

Management

Table Trac is led by its founder Chad Hoehne, who serves as the CEO, CTO and the Chairman of the Board. After a decade at Minneapolis-based electronics manufacturer Micro Control Co, Hoehne founded Table Trac in 1995 after developing an automated table game monitoring system. With 26% ownership of the company, Hoehne has significant skin in the game.

Financials and Future Expectations

Except for 2020 due to the pandemic, Table Trac has demonstrated consistent ability to grow casino locations, sales and EBITDA. Operating expenses as a percent of revenues have fallen from 90% in 2015 to under 60% in 2019 as the company scaled. Given the forthcoming operating leverage, I believe TBTC is on the path to deliver long-term gross margins of 75%, EBITDA margins of 25% and a high level of EBITDA to FCF conversion given minimal annual capital expenditures. Lastly, the company has $2.9 million in cash on the balance sheet and no long-term debt so it will not need to raise capital in the foreseeable future.

At the end of 2020, Hoehne said:

I believe that this last six months will cause casino owners to re-evaluate every aspect of their casino business and the value they’re receiving from their CMS systems. When that occurs, Table Trac Inc.’s CasinoTrac easy to use, easy to maintain system stands out. I believe 2021 will be a very good year for us.

Q1 results confirmed Hoehne's point of view. TBTC delivered quarterly sales of $2.2 million and EBITDA of $788K - both record highs. Considering TBTC delivered $971K of EBITDA in all of 2019, it was an impressive result.

Forward-looking projections are a bit tricky because new system sales can be lumpy based on when the casino operators are ready for the installations. On Table Trac's side, the installs typically only take a couple of days, but they are at the mercy of casino construction, remodeling and random other reasons for delays.

With that being said: For 2021, I am forecasting revenue at $10.2 million (+29% vs 2019) and EBITDA of $2.3 million (+138% vs 2019), driven by the increase in casino demand after COVID, consistent maintenance revenues and a record backlog I've estimated at ~$2.5 million. Any miss to these projects would likely be driven by system installation delays and the backlog should just shift out to 2022.

Valuation and Price Target

From 2017 through 2019, Table Trac consistently traded between 13 - 15x EV/EBITDA on a trailing twelve-month basis.

Applying a 14x multiple to my forecasted $2.3 million in 2021 EBITDA gets me to an enterprise value of $32 million and a target price of $7.50/share, which represents over 100% upside from today's $3.50/share price. Any multiple expansion for this high quality, recurring revenue SaaS business is justified, but that would just be the cherry on top.

Dear Zippy, thank you for your highly interesting write up on TBTC. It makes me think of GLXZ. I was looking at the TBTC Q2 report ( not a lot of detail there in terms of business context) and noted they also sell systems via distributors? Did you get to understand the economics of such sales? Are they just one off worse( margin) and later on better ( license?) or not? I noted a worsening of the gross margin in Q2 vs 2020 and wondered what you thought about it. Also the company mentioned that they have now 12 systems in backlog compared to 9 the previous quarter. So that seems better than your expectation, Thank you Robert