Table Trac: My Favorite Idea

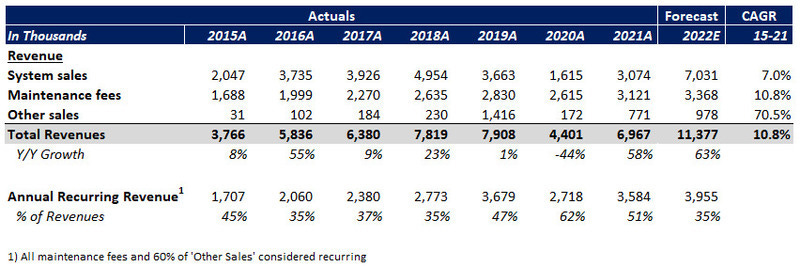

Nanocap software company with accelerating revenues (+66% LTM, record backlog), solid tech, terrific unit economics (~70% incremental EBITDA margins) and just 2% TAM penetration; $9/share target

I previously wrote-up Table Trac in a post last year, but I felt inspired recently to refresh the thesis. E-mail me at chris@zippy-capital or Twitter at @zippy_capital to get in touch.

Table Trac (OTCQX: TBTC; $23mm market cap) is a nanocap company that provides casino management system (CMS) software and related services to over 270 casinos in the United States, Australia, the Caribbean, and Central and South America. The company's flagship 'CasinoTrac' CMS suite includes real-time automated gaming machine monitoring and functionality for casinos to manage loyalty/marketing programs, perform required audit/accounting tasks, and business analytics. The system is affordable, easy to use, and seamlessly interfaces with third-party software. Target customers include tribal and commercial small to medium-sized casinos.

After over two decades of grinding as a minor player in a CMS market dominated by large competitors, Table Trac is at an inflection point. The company has tremendous sales momentum coming out of COVID. It will also enjoy years of EBITDA and FCF margin expansion, given that the recurring gross profits increasingly cover more of the total SG&A and the business has little capex demands.

At ~9x trailing EV/EBITDA, Table Trac shares are inexpensive for a capital-light company with accelerating revenue growth (+66% LTM sales, record systems backlog), medium-term 30%+ EBITDA margins, and continued potential for market share gains (~2% TAM penetration). Individual investors and small funds should accumulate the stock for under $5.50/share. I have a DCF-derived price target of $9/share, representing over 80% upside to today's price.

Key Background Information

Every casino requires CMS software. Is critical to a casino's operations and regulatory compliance.

Founder-led Table Trac punches way above its weight in offering a technologically advantaged yet user-friendly CMS offering, backed up by multiple patents, at a value price point to consumers (these claims are supported by my channel checks).

Sticky product (90%+ retention) generating SaaS-like high-margin recurring revenues providing the business with tremendous operating leverage, as evidenced by historical 70% incremental EBITDA margins (FY17-21).

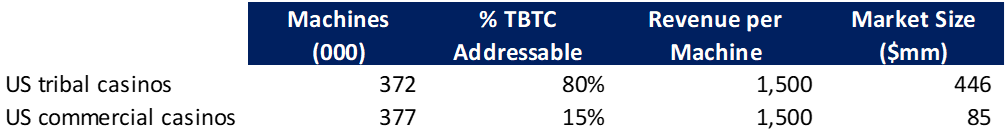

TAM is estimated at $500mm so the company’s LTM revenues of $10mm imply a ~2% market share.

Strong alignment between management and shareholders as the executive team owns 31% of the shares outstanding (Founder/CEO owns 25%).

Business & History

Table Trac was founded in 1995 when CEO Chad Hoehne developed a patented table games management system called 'TableTrac'. From there, the company expanded into slot machine management and introduced a total CMS solution called 'CasinoTrac'. CasinoTrac is 'Saas-like' because the company can push out software updates remotely, but on-premises servers and hardware are required at the casino. SaaS will likely never be an option for CMS, given gaming regulations.

The company has three primary revenues streams:

Sales from new CasinoTrac casino management systems installations (~60% of sales). This business is very capital-light since the servers and hardware sit at the casino, not with Table Trac.

Monthly recurring maintenance fee revenues (~30% of sales) from previously installed systems. Table Trac collects a fee for providing ongoing operational support. Because the only real expense for these services is potentially sending a service technician on-site, this segment has historically reported Gross Margins in the 80-95% range, depending on the year.

Other sales including add-ons to the core CasinoTrac management system, such as DataTrac (business intelligence) and KioskTrac (kiosk games and promotions).

Starting with a single casino in Minnesota over 25 years ago, Table Trac has now expanded to over 270 casinos worldwide today. Founder, CEO, and CTO Chad Hoehne leads a small but prolific development staff with multiple patents and software that many industry insiders consider comparable, if not better, than competitors' products at an affordable price point. Former employees I have spoken to consider Chad a 'genius'.

With annual retention of over 90%, Table Trac's casino operators value the company's products and services. In the past few years, they have consistently won clients from more prominent players by offering their robust software solutions at discount prices. From FY15 to FY21, the company grew revenues at a +11% CAGR while gross margins remained healthy at ~70%.

Competition & Total Addressable Market

Casino management systems (CMS) are software solutions used to assist in the management, monitoring, and operations of a casino. The CMS market is dominated by four large players who also manufacture casino games: Aristocrat (ASX: ALL), Bally Systems (Light & Wonder, NASDAQ: LNW), IGT (NYSE: IGT), and Konami (TSE: 97660). While the big players control most of the market share, the CMS business is an ancillary revenue stream for these companies. For example, Aristocrat IR informed me that CMS revenues contribute less than 5% of their total sales.

In the US, gaming is highly regulated, and manufacturers must receive approvals from local/state gaming commissions before selling to commercial casinos (tribal casinos have different rules). Table Trac is one of the only CMS providers besides the big players to have state approvals to sell their product in multiple states, including Nevada, Colorado, Minnesota, Maryland, Iowa, South Dakota, and Wisconsin. Outside of the US, they sell to locations in the Caribbean, Central and South America, and Australia. The company also has a strategic partner in Japan once its first casinos open.

There are nearly 1,000 casinos in the United States: 466 commercial casinos and 515 tribal ones, per the American Gaming Association. Additionally, there are almost 300 American card rooms and another 17,200 electronic gaming locations (such as restaurants and bars with slot machines). Every gaming location requires casino management software (CMS) for its operations and also for compliance: casinos rely on CMS solutions to rate players, understand performance, manage loyalty programs, and also to perform the required audit, accounting, and reporting to regulators.

About 100 of Table Trac’s 270 casino clients are based in the United States so they have already captured 10% of the casinos in the country, but still have a long way to go to capture the total dollar opportunity given that their customer base is primarily smaller locations.

In triangulating the potential TAM for Table Trac, we have a couple of data points:

Light & Wonder (formerly Scientific Games) says their Systems TAM is $700mm as of 2019 (2022 Investor Day deck).

Grandview Research has the 'global casino management system market size' valued at $5.1B (2019) but this figure includes areas such as security/surveillance and property management which is outside of Table Trac’s scope.

My estimate for the TAM is $500mm, not including non-US casinos. I based this figure on the following assumptions: 1) the number of gaming machines in the US by casino type, as reported by the American Gaming Association, 2) an estimate (%) of how many of those machines Table Trac could realistically acquire and 3) an estimate of annual revenue per machine, in line with information shared to me by the company.

Based on this estimate, I assume that Table Trac has a ~2% market share based on trailing twelve-month revenues of $10mm.

Table Trac’s Competitive Advantages

Can a small 30-person company have a better product offering with large, multi-billion dollar casino game manufacturers in CMS? The CasinoTrac suite compares quite favorably to other options in the market by effectively competing against larger competitors on price, innovation, and cybersecurity.

Price: The CasinoTrac suite is 30-50% cheaper than alternatives offered by the 'big four' but offers similar (or better) functionality. In addition, Table Trac does not charge for software upgrades. With other CMS providers, casino operators can get expensive, multi-million dollar system upgrades fees and software integration costs from competitors that lead them to explore CasinoTrac.

Innovation: Despite having just five dedicated R&D employees (including the CEO), Table Trac is on the cutting edge of CMS technology. The company holds three patents: one for an automated table game monitoring system, another for technology that allows patrons to control a gaming machine with their cell phones, and lastly, one for automated enforcement of social distancing at gaming machines. Two of these patents were granted after 2020. Since the pandemic, the company has been able to roll out new CasinoTrac features for their clients quickly, allowing those casinos to re-open faster.

Cybersecurity: Casinos are popular targets for ransomware attacks: they have a lot of cash and personal information on customers. CasinoTrac protects customers from cyberattacks in ways that similar CMS software cannot. First, CasinoTrac is Linux-based, while other CMS software runs on Windows: this is relevant because hackers have historically targeted Windows the most since it is the most common operating system. In addition, CasinoTrac offers unmatched stability. The software runs on one server, and if there is a catastrophic error, CasinoTrac folds over to a secondary server backing up data in real-time, resulting in less than a minute of downtime. On the other hand, competitor CMS software often has a double-digit number of servers due to clunky technology resulting from many years of acquiring product and slapping it into existing code. System outages on competitor software can last hours, which is very costly for casino operators.

Despite its small size, the CasinoTrac CMS suite is top-notch and above industry standards. My own channel checks support these claims:

Light & Wonder salesperson who previously worked for Table Trac: "[CasinoTrac] is top-notch. I mean it's a Linux-based system. It's easy to install. It's easy to integrate, the APIs for third-party integrations are simple, and it's just very linear…if somebody like Table Trac had the marketing prowess to actually go out there and the sales force, I mean, they could be a disruptor" (Tegus)

Director at regional card room: "One of the challenges with large companies is that the base structure for the platform was built so long along. they just add on, add on and add on and the interface gets complex…If you are in a small market with limited salaries/less trained ppl...you need simple software and CasinoTrac offers that." (Author's interview)

Former General Manager at Regional casino and former Table Trac employee: "I replaced the Aristocrat CMS system (Oasis) and I was very happy with the CasinoTrac CMS. I worked at CasinoTrac for three years, was happy selling the system, and left to work on a gaming property, which is what I enjoy. I think their CMS system is great and I enjoyed the people I worked with. Chad Hoehne is a brilliant and great individual." (Author's interview).

Furthermore, independent software reviews show that CasinoTrac compares favorably to its alternatives from the larger firms. Based on data from Softwarereviews.com, Table Trac outscores the large players on both customer experience and users' likeliness to recommend.

Lastly, Table Trac products have been shortlisted for American Gaming Awards for three years in a row. The awards are more for PR purposes, but these nominations validate that Table Trac is a relevant player in the industry.

Investment Thesis / Catalysts

1) Demand for Table Trac's CMS has never been higher. Revenue growth is inflecting as CasinoTrac gains new state approvals and wins larger and larger casino customers.

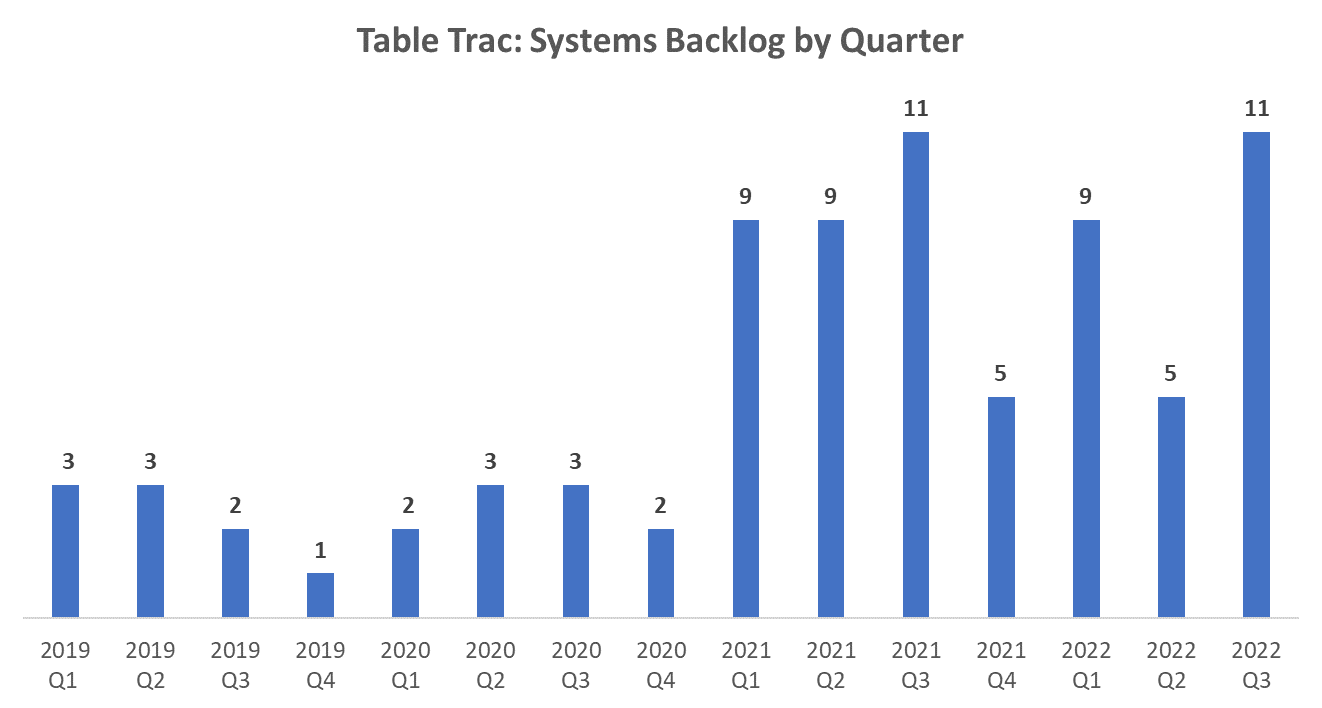

The company has delivered >50% revenue growth for four straight quarters, with LTM sales growth +66% through the third quarter of FY22. A likely driver may have been COVID forcing casinos to review their cost structures, with many turning to CasinoTrac as a cheaper CMS. As the table illustrates below, Table Trac's system install backlog significantly accelerated post-COVID, and that sales momentum continues.

Source: Company filings

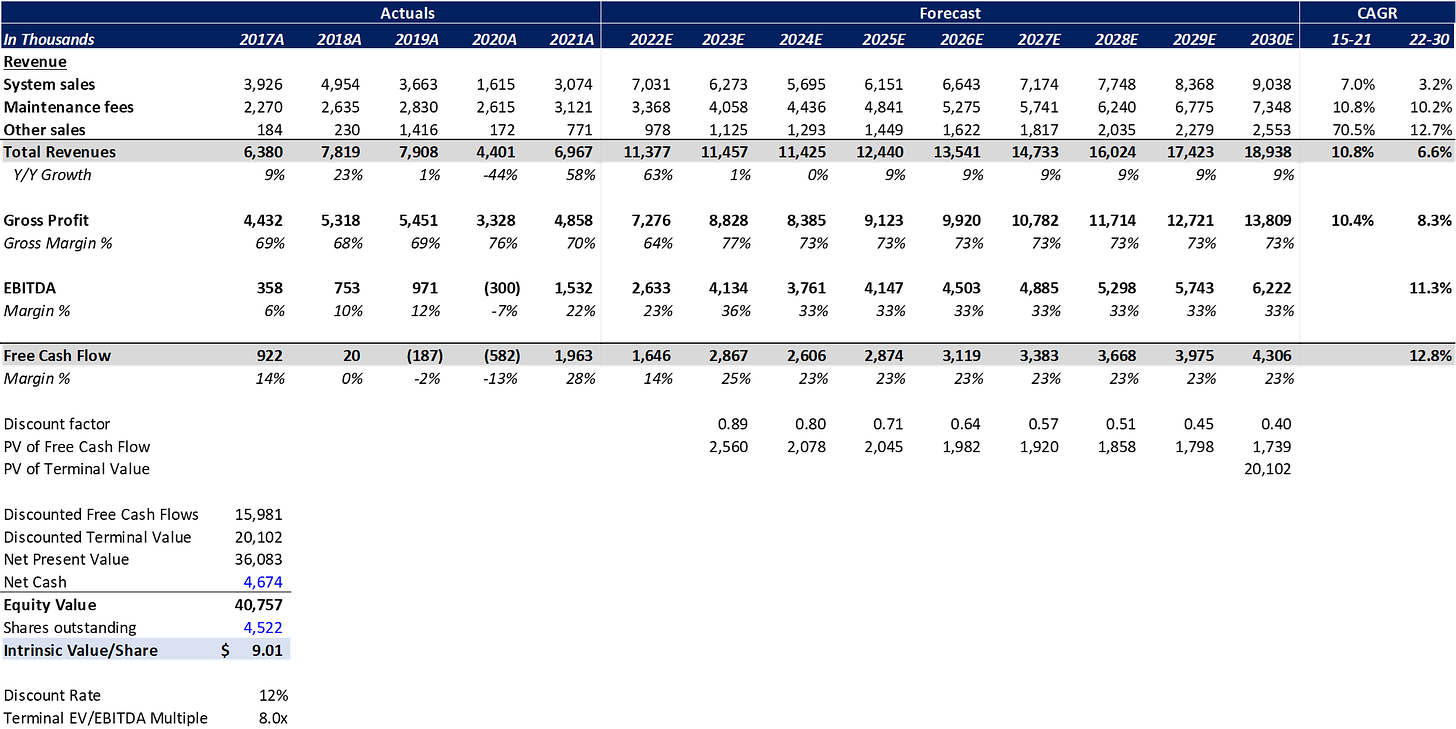

2) Profitability and cash flow generation will significantly improve in the coming years. The company can realistically achieve steady state ~30%+ EBITDA and ~25%+ FCF margins within a couple of years, given that they now have a large enough revenue base in addition to the strong unit economics their offerings always had.

From FY17 to FY21, the business generated ~70% incremental EBITDA margins. The issue in the past has been that their SG&A expenses relative to revenues have been very high (as the most significant expenses are salaries). However, this dynamic will change in the next 1-2 years since Table Trac is close to having its recurring maintenance revenues (and gross profits) entirely cover its SG&A expenses. Once they achieve this level, the gross profit from system sales will flow to the bottom line.

Already, EBITDA margins have advanced from 4% in FY16 to 22% in FY22, and I expect to be over 30% by FY23.

Source: Company filings, Author’s analysis

3) The company is over-capitalized and will start to return a significant portion of the excess cash to shareholders.

The company currently has $4.7 million in cash on the balance sheet (or over 20% of the market cap), no long-term debt, and essentially no capital expenditure needs ($0.1mm of capex in the past five years). As a result, there is great potential for an increased future cash return to shareholders. The company recently declared a token $0.02/share dividend, which translates to $0.4mm in annual dividends payable if paid out each quarter. As a result, there is tremendous room for this dividend to increase. Investors should not rule out the possibility of a larger special dividend either.

4) Overly conservative accounting practices resulted in $2.8mm of revenue from two system installations to be written off in Q2 FY22 (but all associated expenses were recognized in the quarter). The company will recognize the $2.8 over time as cash is received, essentially producing $2.8mm in future 100% pre-tax margin revenues as they get paid.

Earlier this year, Table Trac expanded into Alabama when they installed two systems in that state with system sales revenues of $2.8mm. However, they could not recognize these revenues as they were deemed 'uncollectible' because of an uncertain regulatory environment and some legal disputes with the state at one of the two casinos, confusing market participants and prospective investors. Currently, both the two casinos are open and making payments to Table Trac, so I expect this to be a source of future 100% pre-tax margin sales.

Valuation

While the stock has significantly outperformed market indices this year (+49% YTD), Table Trac shares still represent significant value relative to my DCF-derived price target of $9/share, assuming a 12% discount rate and 8x terminal EV/EBITDA multiple. My financial model assumes revenue % growth in the high single-digits, long-term gross margins of 70%+, and EBITDA margins settling at 33% with ~70% EBITDA to FCF conversion (in reality, FCF may be lumpy as working capital is a large driver).

Concluding Thoughts

The most common pushback I have received on this idea is: 1) Table Trac seems to be gaining customers by undercutting the competition on price, or 2) their tribal/small commercial casino market is very niche. While Table Trac's offerings are cheaper than other CMS, casino clients do not lose much (if any) functionality by switching to CasinoTrac and have benefits that go well beyond cost savings: easier integration with other systems and improved cybersecurity. Regarding the TAM, it is important to consider that Table Trac's market extends well beyond the US: they have business in Australia, the Caribbean, and South America. When only considering the US market the US, I estimate they have only penetrated 2% of their US TAM. However, they are currently in ~10% of American casinos. Investors should interpret this not as a sign that they don't have much more room to grow, but rather that the company is emerging as a real player that can continue to scale and win over larger customers.

Thank you for reading. I welcome all feedback and for people to poke holes in my arguments.

Amazing write up.

It's interesting to note that the largest stakeholder of the IR project in Osaka is MGM. Should their product be selected, in effect, that is MGM greenlighting Casino Trac.